I know minister Ahmad Maslan personally. He is a pleasant fellow on the whole. Most of them are- until they become irrational defenders of their equally irrational leaders.

As a politician however, he can come out with the most madcap of answers. He is to Najib what Sanusi Junid was to Mahathir. I wonder what happened to the padipeople grew on their rooftops. What happened to all the trained pig-tailed macaques that can climb coconut trees at amazing speed? There is a high demand for these animals in by coconut growers in Southern Philippines.

Both of them have the same physique coincidentally. You know what they say about not so tall people- they are willing to engage you in physical fights. So I have to be careful with Ahmad Maslan and need to avoid coming in contact with him at parliament lobby. Furthermore he has a CGPA of almost 4. A brilliant fellow. Same class as Tony Pua and Ong Kian Meng.

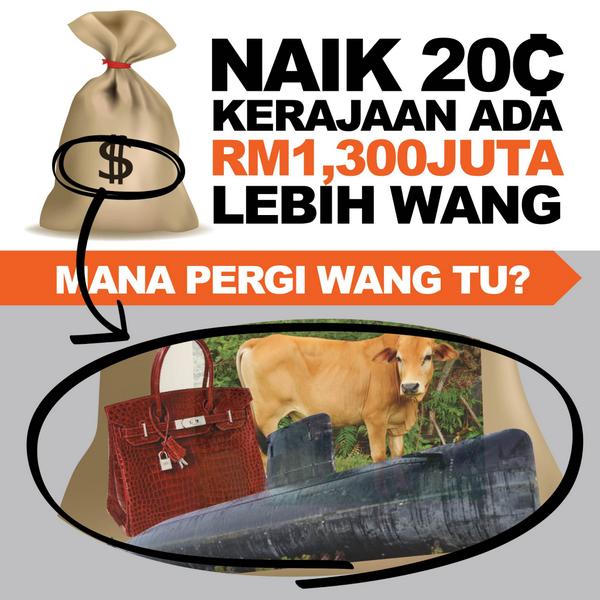

He is reported to have tweeted about the rise in Ron 95 and diesel. In 2013 as I wrote earlier he defended the withdrawal of subsidy in the name of subsidy rationalisation because undeserving people were enjoying the benefits of lower fuel prices. The Mercedes Benz owners, the BMW brigade were using RON95 and diesel was being smuggled out of the country. Since he can’t use the same excuses, he has now defended the increase in prices by reminding people that Najib is the onliest PM in our history to have reduced the price of petrol by 90 sen.

As the late Pak Sako was wont to say- wow!

Wow indeed because Ahamd Maslan is trying to use a Houdini on us. Remember when Pak Lah raised the price of RON 97 to RM2.70 after raising the price twice before? He introduced a scheme where people queued up at post offices and other paying outlets to get reimbursement or petrol rebates. We have not forgotten that- at least we, the Honda and yamaha cup owners, the lower cc cars don’t forget.

Our Najib did not reduce the price of RON97. The price remained as it was during Pak Lah's time. What he did, or the wily oil companies did was to introduce a lower octane fuel known as RON95. It was priced at RM1.80 then. So from RM2.70 to RM1.80, it was indeed a reduction of 90 sen. But it was a different fuel. It was RON95 not RON97 which Pak Lah raised to RM2.70 per litre.

The price of RON95 since 2009 has now increased to RM2.30. So we can now conclude and tell Ahmad Maslan at the same time, that Najib is the onliest PM to have increased the price of RON95 by 50 sen since 2009!

No, we have not forgotten who did what and when.

Impose a tax on petrol and diesel.

Someone sent me a most practical solution to the petrol and diesel issue. (PnD). Why don’t the governed introduce a petrol and diesel (PnD) tax on all private and corporate owned vehicles that are above 1600cc?

In my last article, I said the government does not have any clue how to raise revenue. This is because; they operate from a rent seeker mind-set. Because they own the licenses, monopolies, grants, quota, authority- they are more obsessed with how to extract more and more. So let us propose a moderating solution.

We can agree on one point though- that the target groups ie the lower income people must benefit directly. But withdrawing subsidy because we want to prevent the undeserving ones from benefiting, we have also caused collateral casualties. We want to punish the better off, but the less off get punished too.

Now Ahmad Maslan is always reminding people that the government is spending around RM21 billion a year on subsidies. By the way- that’s only a fraction of the outflow of illicit money out of Malaysia.

The PnD Tax. Suppose the tax subsidy is retained. Will the government consider imposing a petrol and diesel tax? Essentially we know whom to tax for petrol and diesel- tax the owners of bigger capacity cars and tax the big diesel users.

Let us assume that poorer people like us drive lower cc cars- maybe less than 1500cc. not only the cars use less petrol but also incur lower road tax. The bigger capacity cars- above 1600 are driven by better off owners. So we tax them. The tax from these, would cover both private and company registered vehicles.

How do we start? Start by calculating an average annual consumption of petrol and diesel by these vehicle owners. The work to be done by the transport ministry people. Once the average annual consumption is known, that figure can be used as a basis for calculating the proposed petrol and diesel tax. Suppose the government wants to recover RM8 billion- they have to work backwards to arrive at the quantum figure on tax. The proposed tax band would cover vehicles with capacities ranging from 1601-2000, 2001-2500; 2510-3000, 3001 and above.

The government sets a tax rate on these vehicles and collect the taxes at the next road tax renewals. The tax can be collected by JPJ or any other authorised bodies having access to JPJ data base. If MYeg uses this proposal, they would have to pay me.

The PnD tax will also be applied to foreign vehicles. The tax on all incoming vehicles either from Thailand, or Singapore will be paid at our customs offices.

The revenue collected will offset the amount of subsidy given out. The revenue collected from the PnD tax will be credited into a central subsidy management fund controlled of course by the Finance Ministry.

The government has to implement some kind of PnD tax to redistribute real income. The better off with higher capacity cars will have to pay taxes so that they help reduce the subsidy burden of the government Maybe that will reduce the annual RM21 billion on petrol subsidies and we can be shielded from Ahmad Maslan’s annoying parrot calls on how much subsidy this caring government gives out. It has become nauseatingly irritating.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.